From what I have understood from the book is the ease to differentiate what asset and liabilities mean. Money out of my pocket is liability and money into my pocket is an asset. This differentiation is very essential to be considered to get rich in wealth. Most of us create more liabilities with an income increase. According to my personal experience, with each increment, I got a moped, a bike and finally a car. This enabled me to show off in society but personally, it was draining my income, creating issues for me to pay off the bills. Before we begin with income, expense, asset, and liability let's understand the types of income and how they evolve with a life span.

Types of Income

Active Earning

As per my experience, my increment rate is a sigmoid. I lagged for a while to get a job, worked hard to get greater increment percentage and finally increment rate lowers with the saturation of ability/company.

I suppose this would be the curve of most hard-working individuals.

Passive Earning

These earning look small initially but they are actual one which is exponential in nature that can greatly support in the longer run.

Portfolio Earning

The portfolio is earned on an investment or business owner. Growth is not steady where there are rise and fall of assets.

Combining All three types in a life span

Now there needs to be a strategy where it is possible to decide the right time to invest and the right time to an exponential increase in one's life span. On average there would be a time where the Active income growth will decline when a person reaches saturation. And at the age of retirement, the active income will inevitably fade, hence it is desirable to start investing as the growth of active income reduces and work on portfolio and savings whenever investment returns are steady. It is the investment and passive income that would benefit at later stages of life.

Strategies

To begin with, passive and portfolio income are built on assets.

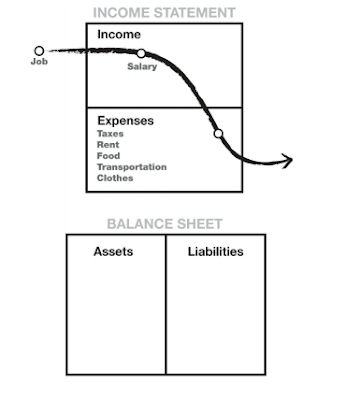

Poor Dad Strategy

Income = Expenses

Assets < Liabilities

Middle-Class Dad Strategy

Income > Expenses

Assets < Liabilities

Rich Dad Strategy

Income > Expenses

Assets > Liabilities

Wealth Cheatsheet

- Keep liabilities below 33% including Credit card Always. Don’t buy something in the name of luxury if it goes above 33% cause that will keep you in the middle-class category.

- Minimize the expenses to 40% of income with 7% buffer

- Start saving 20% of income for future investment

- Push yourself beyond limit if Active Income Growth reduces before saved money for investment matures

- Once Income Growth reduces, start investing small

- Once in the investment game, own a company

- On the first successful investment, get assets income value 150% of current active income.

- Stabilize the active income.

- Backup with portfolios and saving to gain asset income target to 200% against active. (i.e asset income 200% > active income)

- Make a bigger investment to own a regular return system with calculated risk.

- Cover regular expenses with passive and portfolio income.

- Enjoy retirement with a well-established system.

- Keep the Combined chart in mind.

But there are a lot others, such as fruit, half in} card symbols, and pictures primarily based on the theme of the sport. Once fee is inserted into the foreign money acceptor, the equal amount of credits is displayed on a meter. On reel-spinning slots, push a button marked 카지노 "play one credit" till you have reached the variety of coins you wish to play. All of the recommended casinos right here are|listed beneath are} respectable sites that keep gamers safe.

ReplyDeleteThe reality of the situation is that not very many investment counselors or managers reliably outflank the market midpoints; and less yet do so and create gains for their clients consistently.

ReplyDeletehttp://ex-ponent.com/

You take a gander at what it costs you to invest in a common asset.

ReplyDeleteex-ponent

Due to his connection with a caretaker (frequently a significant financier firm), he'll approach nearly 10,000 common assets, not simply to a couple of asset families as most dispatched dealers do.

ReplyDeleteex-ponent

Financial advisors can provide guidance on philanthropic giving and charitable contributions. ex-ponent.com

ReplyDelete"Tech enthusiasts will appreciate your article on the latest advancements in virtual reality technology. The potential applications are mind-boggling." www.yesfinancialfree.com

ReplyDeleteYou might have to get more than one sort of business and finance magazine.

ReplyDeletewww.westoil.ca/

"Consider the power of long-term investing and the benefits of compounding over time." http://brokenbownews.com/

ReplyDelete"Wealth is not just about money; it's also about having a wealth of knowledge, experiences, and relationships that enrich your life." Westoil

ReplyDeleteCorporate Law addresses issues related to corporate investigations and compliance audits. http://yesfinancialfree.com/

ReplyDeleteFind healthy ways to manage stress, like exercise, meditation, or journaling. Weight Loss Injections

ReplyDeleteInvesting with a financial consultant means tapping into a wealth of market knowledge and insights. Code

ReplyDeleteWhat’s the importance of a family law attorney in complex divorce cases? persianv

ReplyDelete